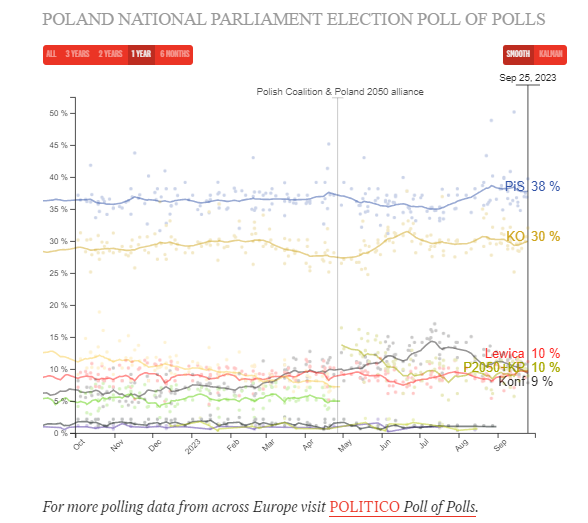

The Polish government is facing accusations it artificially lowered consumer prices — especially on core goods like fuel and medicines — to allow the central bank to make a crowd-pleasing interest rate cut before an election on October 15.

National Bank of Poland Governor Adam Glapiński, an appointee of the incumbent Law and Justice (PiS) party, terrified financial markets earlier this month by cutting benchmark rates by a full 0.75 percentage points to 6 percent on the seemingly shaky grounds that Poland’s sky-high inflation was finally cooling.

But now the data has more than vindicated Glapiński’s gambit, with the rise in Polish consumer prices slowing to 8.2 percent in September, down from 10.1 in August and 0.2 percentage points lower than forecasts, data showed on Friday.

The question of how these prices are coming down, however, is turning into a political quagmire — with the opposition suggesting a state-dominated energy giant is deliberately keeping fuel prices low in the run-up to the general election. The government has also pushed through a measure lowering power prices for consumers as well as expanding the number of people able to get free medicines.

”This is a political price, not an economic price, and this is obvious,” said former Deputy Prime Minister Jerzy Hausner, a vocal critic of the government and a former member of the central bank’s Monetary Policy Committee. “[But] because this is coming from a state monopolist, it means they can do it this way. Price manipulation is something we are seeing increasingly.”

The cut on September 7 was seen as fresh evidence of Glapiński’s willingness to violate his bank’s cherished political independence, which observers say is becoming increasingly tenuous. In May, the central bank put up a banner attempting to deflect the blame for Poland’s soaring inflation on Russia and the pandemic — pointedly exonerating the government.

Now critics wonder how he was able to deliver such a bumper cut and keep inflation down just as his allies in PiS fight a bitter campaign for reelection.

“There is no doubt that Governor Glapiński made a decision that borrowers may like, and it was no accident that he made this decision, and on a surprising scale, a month before the elections,” Donald Tusk, leader of the liberal Civic Platform party, the main election rival of Law and Justice, said earlier this month.

The easing of inflation was driven in large part by an annual slowdown in utilities price inflation to 10.9 percent from 13.9 percent, wrote Liam Peach, senior emerging markets economist at Capital Economics in a note to investors. Motor fuel prices actually fell by 3.1 percent on a monthly basis.

“Despite the recent rise in global oil prices,” Peach wrote, “reports suggest that there has been downward pressure on local fuel prices at petrol stations ahead of next month’s election.”

Glapiński has rubbished the idea of the central bank being politically compromised, arguing that he pushed through the cuts on the grounds of modeling that indicated inflation would finally fall below 10 percent in September. That’s a level the bank previously stated needed to be broken for rate cuts to begin — but which analysts have dismissed as being entirely arbitrary.

One Warsaw-based analyst working for an international bank told POLITICO the 10 percent threshold had nothing to do with any formal targets and was thus misleadingly being celebrated.

“He is selling it with great success to the public and the media,” the analyst said, having been granted anonymity because of Glapiński’s habit of verbally attacking commentators. “Even we economists are saying this … it is a full propaganda project.”

Though the strategy does seem to be working, the success of Glapiński’s political gambit may well be short-lived, with professional forecasters recently raising their expectations for Polish inflation in 2025 to 4.3 percent from 4 percent. But that doesn’t mean the central bank will stop cutting rates.

“It’s part of a broader picture in which the central bank and the government are trying to convince the public that inflation is no longer a problem,” said Adam Antoniak, Poland analyst at ING bank.

Suspicions

Suspicions that prices were being manipulated arose after Polish retail fuel prices diverged significantly from other Central European countries, falling 7 percent in the first two weeks of September relative to rises of 1.8 percent and 1.4 percent in Hungary and Czech Republic respectively, according to a report by Goldman Sachs.

ING’s Antoniak agreed the drop in retail and wholesale prices was “quite surprising.”

“It doesn’t look like anything typical for this time of year,” he added. “It seems obvious that this is temporary — and that prices will return after elections.”

But that view doesn’t necessarily square with the data. According to Bloomberg prices, benchmark European fuel, known as Euro-bob, fell 8 per cent in the comparable period, implying Poland’s energy retail prices may simply be following a broader decline in wholesale prices. These historically reprice lower in September in Europe in line with a mandated switch from “summer” fuel grades to “winter” ones. Data from globaldieselprices.com corroborated that pump prices have either stayed flat or fallen in September across most of Western Europe.

The picture is muddied too by indications that conditions in Hungary and the Czech Republic could be driven by local idiosyncrasies. Hungary’s MOL refinery has been hit by Ukraine demanding higher fees in recent weeks for the Russian crude it transits across its territory, while the Czech Republic reintroduced diesel excise duties on August 1.

Polish government critics nonetheless have seized on the domestic decline to accuse energy conglomerate PKN-Orlen, which is 49 percent owned by the Polish state and the dominant market player in the country, of manipulating prices for political purposes, and are now calling for a European Commission investigation.

The government’s outsized control over both the energy sector and economy makes it easy to “interfere in the market,” said Grzegorz Drozdz, an analyst at the investment firm Conotoxia Ltd. That means the low prices are akin to an unofficial “price freeze.”

But while Commission officials told POLITICO they were “constantly monitoring the situation in the EU fuel markets with a view to detecting potential infringements of the EU competition rules,” they did not confirm they viewed the Polish case as manipulation.

Hesitation to intervene could be down to how many European Union countries have benefited from energy-related subsidies this year to deal with the energy shocks caused by the invasion of Ukraine by Russia in 2022.

The mechanics of restricting government-owned enterprises from engaging in anti-competitive practices or market collusion are further complicated by the fact that such interventions are politically mandated by design.

“European government intervention in fuel markets through taxes and subsidies is the rule, not the exception,” said Craig Pirrong, an economist at the University of Houston and an international expert in commodity market manipulation. “By the logic of the critics of Polish fuel pricing, all are guilty of manipulation all the time.”

“Comparisons to wholesale prices and taking into account seasonal factors are more informative,” he added.

PKN Orlen itself has rubbished the claims of manipulation arguing its price improvements can be explained by efficiencies drawn from its recent acquisition of domestic rivals Lotos, PGNiG and Energa.

“Thanks to the integration of supply, trading and purchasing we are able to effectively meet all the needs of the entire PKN Orlen group,” the company’s Director of Communications, Adam Kasprzyk, said in a video posted on X, formerly Twitter, this week. “With the exception of unexpected interruptions or shocks, which the group has no control over, there is no risk of fuel shortages or imminent higher prices.”

In the same video, Kasprzyk appealed to Polish citizens not to resort to panic buying on the assumption that low prices may be temporary.

Source : Politico